How to Strategically Invest in Industrial Real Estate in Canada

Looking to diversify your portfolio with tangible, income-producing assets? Join our FREE WEBINAR!

We understand that many investors are frustrated with underperforming RRSPs and traditional market volatility—and are looking for better ways to grow wealth without taking on unnecessary risk.

Industrial real estate in Western Canada is proving to be one of the most stable, high-performing investment classes of 2025—and now, you can own a piece of it through a professionally managed, RRSP-eligible private REIT.

Join us for this exclusive live webinar where we will take you inside the strategy behind our $100M+ portfolio and show you how investors are earning passive income from fully leased, professionally managed industrial buildings across Alberta, BC, and Saskatchewan.

Industrial real estate in Western Canada is proving to be one of the most stable, high-performing investment classes of 2025—and now, you can own a piece of it through a professionally managed, RRSP-eligible private REIT.

Join us for this exclusive live webinar where we will take you inside the strategy behind our $100M+ portfolio and show you how investors are earning passive income from fully leased, professionally managed industrial buildings across Alberta, BC, and Saskatchewan.

Industrial real estate in Western Canada is proving to be one of the most stable, high-performing investment classes of 2025—and now, you can own a piece of it through a professionally managed, RRSP-eligible private REIT.

Join us for this exclusive live webinar where we will take you inside the strategy behind our $100M+ portfolio and show you how investors are earning passive income from fully leased, professionally managed industrial buildings across Alberta, BC, and Saskatchewan.

Join our FREE WEBINAR with Mike O’Brien, Investor Relations Manager of InvestPlus REIT

Tuesday, November 18, 2025

6PM MT / 8PM ET

Live on Zoom

November 18, 2025

Tuesday

6PM MT / 8PM ET

📍Live on Zoom

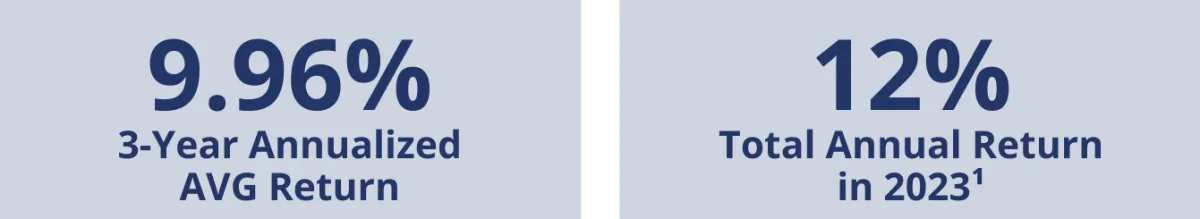

Proven Track Record (Target Return 7%-12%)

With over two decades of experience, InvestPlus REIT has demonstrated strong historical returns

Quarterly Income

InvestPlus REIT has never missed a distribution payment since 2015 and has paid over 6% ever year in distributions to their unitholders through acquiring income-producing properties with strong, long-term tenants.¹

100% Focused in Canada

Own your part in the growing industrial market in western Canada through our well-managed and diversified portfolio.

Expert Guidance

InvestPlus has been investing in Red Deer for the last 5 years! Learn how they identify their properties and deliver long-term returns.

Who Should Attend This Webinar?

This session is ideal for:

- Investors who are already familiar with REITs or private real estate offerings

- Individuals with RRSPs, TFSAs, or LIRAs looking to reallocate toward income-producing assets

- Portfolio diversifiers interested in alternative investments backed by hard assets

- Canadians seeking passive income without property management responsibilities

Who Should Attend This Webinar?

This session is ideal for:

- Investors who are already familiar with REITs or private real estate offerings

- Individuals with RRSPs, TFSAs, or LIRAs looking to reallocate toward income-producing assets

- Portfolio diversifiers interested in alternative investments backed by hard assets

- Canadians seeking passive income without property management responsibilities

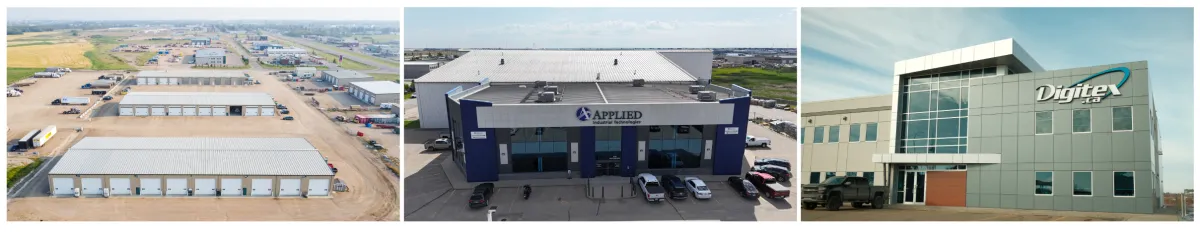

A Closer Look at Our Latest Acquisition:

In late 2024, InvestPlus REIT completed the acquisition of four industrial properties in Alberta—strategically located and 100% leased to a national manufacturer under a long-term agreement.

This $14.65 million acquisition wasn’t just about growth—it was about strengthening the trust’s foundation with quality assets, reliable income, and long-term upside.

📈 What This Means for Our Investors:

- Portfolio Now 600,000+ sq. ft. of income-generating industrial space

- AUM Reaches $108M with this strategic acquisition

- $3.6M+ in Value Created over 9 years after distributions

- 5.13% Fixed Financing from National Bank for long-term cash flow stability

In this FREE Webinar, you will learn:

How you can use your RRSPs to participate in investing in commercial buildings—without needing large sums of money and management teams!

How to be part of a $108M portfolio of buildings from BC to Saskatchewan with as little as $25,000.

What real estate assets are doing well, and which may be potentially extinct from the market.

How InvestPlus REIT values real estate deals and how that influences the return to investors like you.

Fill out the form below to reserve your spot!

In this FREE Webinar,

you will learn:

How you can use your RRSPs to participate in investing in commercial buildings—without needing large sums of money and management teams!

How to be part of a $108M portfolio of buildings from BC to Saskatchewan with as little as $25,000.

What real estate assets are doing well, and which may be potentially extinct from the market.

How InvestPlus REIT values real estate deals and how that influences the return to investors like you.

Fill out the form below to reserve your spot:

Meet Your Speaker

Mike O’Brien

Investor Relations Manager, InvestPlus REIT

Mike O’Brien brings over 30 years of experience in investment and financial services to his role at InvestPlus REIT. Since joining in 2025 as Investor Relations Manager, he has been instrumental in driving asset growth and building trusted relationships with both new and existing investors.

Over the course of his career, Mike has worked extensively across Canada with leading financial institutions, including Raymond James, RBC, and boutique firms such as Canadian Wealth Management. He is well known for his excellence in relationship management and business analytics, consistently helping clients reach their financial goals through personalized strategies and innovative financial education.

A passionate advocate for financial literacy, Mike spent 20 years teaching Personal Financial Management at the University of Calgary’s Continuing Education department. He remains a lifelong learner and educator, committed to empowering investors with knowledge, clarity, and confidence.

InvestPlus Real Estate Investment Trust (IP REIT) is a private real estate investment fund, based in Calgary, Alberta. IP REIT is a growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition, ownership and management of industrial properties in primary and secondary markets in western Canada. As of Q4 2024 the total Assets Under Management are $108,000,000 and comprised of more than 600,000 square feet of leasable area.

DISCLAIMER IMPORTANT INFORMATION: This communication is for information purposes only and is not, and under no circumstances to be construed as, an invitation to make an investment in InvesPlus REIT. Investing in theInvestPlus REIT Units involves risks. There is currently no secondary market through which the InvestPlus REIT Units may be sold and there can be no assurance that any such market will develop. A return on an investment inInvestPlus REIT Units is not comparable to the return on an investment in a fixed-income security. The recovery of an initial investment is at risk, and the anticipated return on such an investment is based on many performanceassumptions. Although InvestPlus REIT intends to make regular distributions to its available cash to Unit holders, such distributions may be reduced or suspended. The actual amount distributed will depend on numerous factors,including InvestPlus REIT's financial performance, debt covenants and obligations, interest rates, working capital requirements and future capital requirements. In addition, the market value of the InvestPlus REIT Units may decline ifInvestPlus REIT is unable to meet its cash distribution targets in the future, and that decline may be material. It is important for an investor to consider the particular risk factors that may affect the industry in which it is investing andtherefore the stability of the distributions that it receives. There can be no assurance that the income tax laws, and the treatment of mutual trusts will not be changed in a manner which adversely affects InvestPlus REIT.

NOTES: 1.Investment Growth: No assurances can be given that the Target Return or overall returns will be achieved. See the full offering materials including the offering memorandum for further details, terms and conditions.

© 2025 Copyright InvestPlus REIT

All Rights Reserved.

Privacy Policy | Terms & Conditions